Best Mutual Funds for SIP in 2024: Maximizing Your Investment Potential

Systematic Investment Plans (SIPs) have gained immense popularity among investors looking to build wealth over time through disciplined and regular investments. The year 2024 brings new opportunities in the mutual fund landscape, with several funds standing out for their potential to deliver consistent returns. Selecting the right mutual funds for SIP can significantly impact your long-term financial goals, whether you aim for wealth creation, retirement planning, or funding education. This article delves into some of the best mutual funds for SIP in 2024, helping you make informed investment decisions.

Why SIPs Remain a Popular Investment Choice

SIPs are an efficient way to invest in mutual funds, offering the benefit of rupee cost averaging and compounding over time. By investing a fixed amount regularly, investors can mitigate the impact of market volatility, as they purchase more units when prices are low and fewer units when prices are high. Moreover, regular investing helps build a substantial corpus over time without the need for large initial capital.

Start Investing In Mutual Funds, Open a Free Demat Account & Start SIP Today. Click Below.

https://choiceindia.com/mutual-funds-investment?refercode=QzAwMTk2NzU=&source=Q0hPSUNFX0NPTk5FQ1Q=

Best Equity Mutual Funds for SIP in 2024

Mirae Asset Large Cap Fund

The Mirae Asset Large Cap Fund continues to be a top performer in the large-cap category, making it an excellent choice for SIP in 2024. The fund has consistently outperformed its benchmark, providing investors with strong returns over the years. Its investment strategy focuses on blue-chip companies with a strong track record of growth and stability, making it a relatively safer option for those seeking exposure to equity markets with lower risk.

Overview of Mirae Asset Large Cap Fund:

Investment Objective:

The primary objective of Mirae Asset Large Cap Fund is to achieve long-term capital growth by investing primarily in large-cap companies. These are companies that are ranked within the top 100 in terms of market capitalization. Large-cap companies are typically leaders in their respective industries, which gives them a relatively stable financial standing, higher market share, and resilience during market downturns.

Portfolio Composition:

Mirae Asset Large Cap Fund maintains a diversified portfolio primarily consisting of large-cap stocks across various sectors. The fund’s portfolio is typically dominated by companies in sectors like financial services, technology, consumer goods, healthcare, and energy. The focus is on quality companies with strong fundamentals, proven track records, and sustainable business models.

The large-cap space offers an advantage of relatively lower risk compared to mid-cap and small-cap funds, as these companies tend to be more mature and have consistent revenue streams. The fund managers of Mirae Asset Large Cap Fund carefully analyze the financial health, competitive advantages, and growth prospects of companies before including them in the portfolio.

Key Features:

- Diversification: The fund invests in a wide range of sectors, which reduces sector-specific risk and ensures balanced growth potential. By spreading investments across industries such as banking, technology, pharmaceuticals, and consumer goods, it aims to minimize risks associated with any single sector or company.

- Focus on Blue-Chip Companies: Being a large-cap fund, the portfolio focuses on established companies with large market capitalizations. These companies are often leaders in their industries, providing the potential for stable returns, even in volatile markets.

- Risk-Return Profile: Large-cap funds are generally less volatile compared to mid-cap and small-cap funds, making Mirae Asset Large Cap Fund suitable for conservative investors seeking steady, long-term growth. While it may not provide exceptionally high returns in short periods, the fund offers relatively stable and sustainable growth over time.

- Fund Performance: Historically, Mirae Asset Large Cap Fund has delivered competitive returns, often outperforming its benchmark index over the long term. The fund’s disciplined investment approach and focus on quality stocks have contributed to its strong performance.

- Experienced Fund Management: The fund is managed by experienced professionals with a deep understanding of the equity market. The fund managers use a bottom-up approach for stock selection, combining both fundamental analysis and macroeconomic trends to build a robust portfolio.

Suitable for Long-Term Investors:

Mirae Asset Large Cap Fund is best suited for investors with a long-term investment horizon of 5 years or more. Equity markets can be volatile in the short term, but large-cap companies tend to recover faster during market corrections and economic downturns. The fund is designed for investors looking to build wealth gradually and take advantage of the compounding effect over the years.

Taxation:

Being an equity mutual fund, Mirae Asset Large Cap Fund is subject to equity taxation. Short-term capital gains (if units are sold within one year) are taxed at 15%, while long-term capital gains (for holdings beyond one year) above ₹1 lakh are taxed at 10%, without the benefit of indexation.

SIP Option:

The fund also offers a Systematic Investment Plan (SIP) option, which allows investors to invest small amounts regularly. SIPs provide the benefit of rupee cost averaging, which helps in mitigating market volatility, and also encourages disciplined investing.

Conclusion:

Mirae Asset Large Cap Fund is an ideal choice for investors who seek stable, long-term capital growth through investments in large, well-established companies. With a diversified portfolio, a focus on quality stocks, and a proven track record, the fund offers a balanced approach for those looking to invest in the equity market with relatively lower risk compared to smaller-cap funds. While past performance is not a guarantee of future returns, the fund’s strategy and disciplined investment approach make it a reliable option for long-term wealth creation.

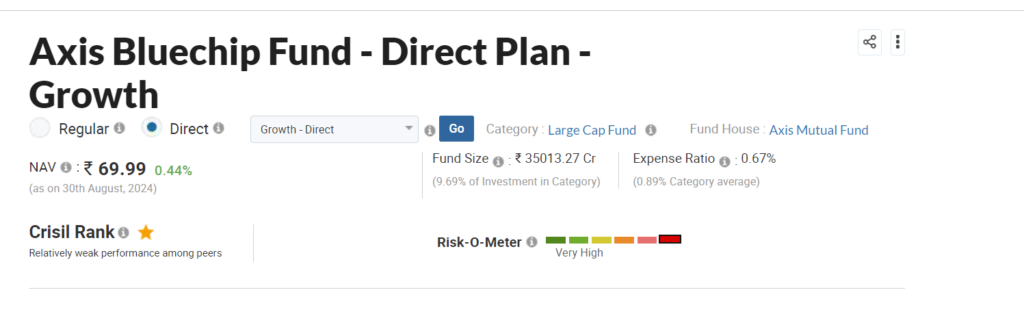

Axis Bluechip Fund

Another solid choice for SIP investors is the Axis Bluechip Fund, known for its consistent performance and risk management. The fund invests in large-cap stocks with robust fundamentals and is managed by a team with a strong track record in equity research and portfolio management. Investors looking for steady growth and capital preservation should consider this fund for their SIP portfolio in 2024.

Investment Objective:

The main objective of Axis Bluechip Fund is to provide long-term capital appreciation by predominantly investing in large-cap companies. These are the top 100 companies in terms of market capitalization, typically characterized by robust business models, strong balance sheets, and a history of stable financial performance.

The fund focuses on high-quality companies that have the potential to grow steadily over time. Blue-chip companies are often industry leaders and have a proven track record of delivering consistent returns, even during periods of market volatility.

Portfolio Composition:

Axis Bluechip Fund primarily invests in large-cap companies across various sectors. The fund follows a concentrated approach, typically holding around 30-50 high-conviction stocks in the portfolio. This concentrated strategy helps the fund take significant positions in top-performing companies, although it may result in sector or stock-specific risk.

The portfolio is diversified across key sectors such as financial services, technology, consumer goods, pharmaceuticals, and energy. A significant portion of the portfolio often includes well-known companies like HDFC Bank, Reliance Industries, Infosys, TCS, and ICICI Bank.

Key Features of Axis Bluechip Fund:

- Focus on Large-Cap Companies: The fund primarily invests in large-cap companies, which are known for their stability and resilience during market fluctuations. These companies generally offer steady returns, making the fund suitable for conservative equity investors.

- High-Quality Stock Selection: The fund managers follow a bottom-up approach, focusing on quality companies with strong fundamentals, good corporate governance, and sustainable business models. This ensures that the portfolio comprises well-established companies that are leaders in their respective sectors.

- Risk-Return Profile: Axis Bluechip Fund is designed for investors with a moderate risk appetite who are looking for long-term growth. Large-cap funds tend to be less volatile compared to mid-cap and small-cap funds, providing a balance between risk and returns. While the returns may not be as high as smaller-cap funds in a bull market, large-cap funds like Axis Bluechip are generally more resilient during market downturns.

- Strong Fund Performance: Over the years, Axis Bluechip Fund has delivered competitive returns, often outperforming its benchmark, the Nifty 50 Index. This performance is attributed to the fund’s emphasis on high-quality large-cap stocks and its disciplined investment strategy.

- Experienced Fund Management: The fund is managed by experienced professionals who have a deep understanding of the equity market. The fund managers employ a research-driven approach to stock selection, focusing on companies with strong earnings growth, sustainable competitive advantages, and long-term potential.

Investment Horizon:

Axis Bluechip Fund is best suited for investors with a long-term investment horizon of at least 5-7 years. The equity market can be volatile in the short term, but large-cap companies tend to recover more quickly from market corrections. Therefore, the fund is ideal for investors who are patient and want to benefit from the growth potential of blue-chip companies over the long run.

Systematic Investment Plan (SIP) Option:

For investors looking to invest in a disciplined manner, Axis Bluechip Fund offers the SIP option, allowing them to invest small amounts at regular intervals. SIPs provide the benefit of rupee cost averaging, which can help reduce the impact of market volatility. It also instils a habit of regular investing, which is crucial for long-term wealth creation.

Taxation:

Axis Bluechip Fund is subject to equity mutual fund taxation. If an investor redeems units within one year of investment, the gains are treated as short-term capital gains and are taxed at 15%. If the units are held for more than one year, long-term capital gains tax applies at 10% on gains exceeding ₹1 lakh, without indexation benefits.

Conclusion:

Axis Bluechip Fund is a solid investment choice for those seeking long-term capital growth through investments in large-cap, blue-chip companies. Its focus on quality stock selection, disciplined management, and diversified portfolio makes it a reliable option for conservative investors who want exposure to the equity market while minimizing risk. By investing in well-established companies, Axis Bluechip Fund provides the potential for consistent and stable returns, making it an excellent option for long-term wealth creation.

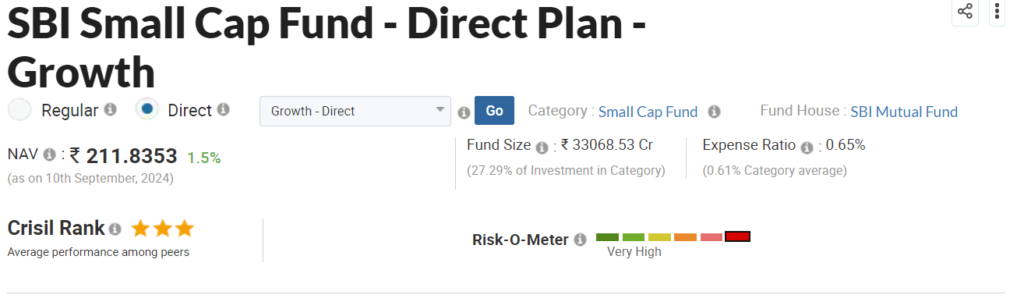

SBI Small Cap Fund

For investors willing to take on higher risk for potentially higher returns, the SBI Small Cap Fund stands out in the small-cap category. This fund has delivered impressive returns by investing in high-growth potential companies within the small-cap segment. While small-cap funds can be volatile, the SBI Small Cap Fund has shown resilience and strong performance, making it a suitable choice for aggressive investors in 2024.

SBI Small Cap Fund is one of the most popular mutual fund schemes in India that focuses on investing in small-cap companies. Launched in September 2009, the fund aims to generate long-term capital appreciation by investing predominantly in small-cap stocks. These companies are typically in the early stages of growth and have the potential to deliver higher returns, although they come with higher risks due to their volatility.

Investment Objective:

The primary objective of SBI Small Cap Fund is to provide long-term capital appreciation by investing in a well-diversified portfolio of small-cap companies. These are companies ranked below the top 250 stocks in terms of market capitalization. Small-cap companies are usually younger, have high growth potential, and are often leaders in niche sectors.

The fund focuses on identifying small-cap companies with strong business models, sound management, and potential for expansion. By tapping into the growth potential of these businesses, the fund aims to deliver superior returns over a long-term investment horizon.

Portfolio Composition:

SBI Small Cap Fund invests primarily in small-cap stocks, with some allocation to mid-cap and large-cap companies to balance the risk. The portfolio is highly diversified across sectors, with a focus on industries such as industrial manufacturing, chemicals, consumer goods, pharmaceuticals, and information technology.

The fund follows a bottom-up approach to stock selection, identifying companies with strong fundamentals, sustainable competitive advantages, and growth potential. The investment strategy focuses on high-conviction stocks, which means the portfolio is concentrated in fewer high-potential small-cap companies.

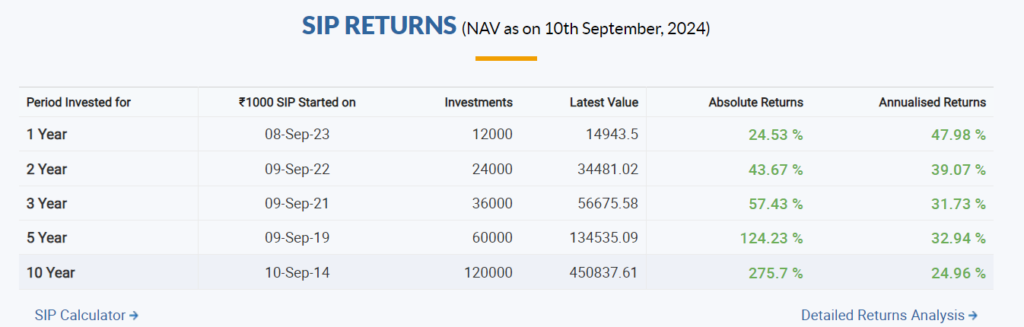

Historical Returns:

SBI Small Cap Fund has consistently delivered impressive returns over the years, often outperforming its benchmark, the S&P BSE Small Cap Index.

Here is an overview of the fund’s historical performance:

- 1-year return: Around 25-30%

- 3-year return: Around 20-25% CAGR (Compounded Annual Growth Rate)

- 5-year return: Around 20% CAGR

- Since inception: The fund has delivered an average return of around 17-18% annually.

While the returns can vary depending on market conditions, SBI Small Cap Fund has demonstrated strong long-term performance, especially for investors who remain invested through market cycles.

Key Features:

- High Growth Potential: Small-cap companies offer the potential for significant growth as they expand and develop their market presence. These companies are often in the early stages of their life cycle, and if they succeed, the stock prices can increase substantially.

- High Risk-High Reward: Small-cap funds tend to be more volatile than large-cap or mid-cap funds. They can experience sharp price fluctuations in the short term, making them suitable for investors with a higher risk tolerance. The fund is ideal for those willing to invest with a long-term perspective, as small-cap stocks can be impacted by market volatility in the short term.

- Experienced Fund Management: The fund is managed by R. Srinivasan, an experienced fund manager with deep knowledge of small-cap companies and the equity market. His expertise in identifying promising small-cap stocks and managing the fund’s exposure to risk has contributed to the fund’s consistent performance.

- Diversification: Despite its focus on small-cap companies, SBI Small Cap Fund maintains a diversified portfolio, which helps reduce the risk associated with individual stocks. By investing across different sectors and industries, the fund aims to provide balanced growth opportunities.

Suitability:

SBI Small Cap Fund is suitable for investors who:

- Have a long-term investment horizon of 5-7 years or more.

- Are willing to take on higher risk for the potential of higher returns.

- Want exposure to high-growth, small-cap companies with the ability to compound wealth over time.

SIP Investment Option:

For those looking to invest in a disciplined and systematic way, the fund offers a Systematic Investment Plan (SIP) option. SIPs allow investors to invest small amounts at regular intervals, reducing the impact of market volatility and enabling them to benefit from rupee cost averaging.

Taxation:

Like other equity mutual funds, SBI Small Cap Fund is subject to equity taxation. Short-term capital gains (if units are redeemed within one year) are taxed at 15%. Long-term capital gains (if units are held for more than one year) are taxed at 10% on gains exceeding ₹1 lakh in a financial year.

Conclusion:

SBI Small Cap Fund offers an excellent opportunity for investors looking for high growth potential by investing in small-cap companies. While the fund is volatile and comes with higher risks, its long-term track record, strong fund management, and well-diversified portfolio make it a solid option for aggressive investors seeking capital appreciation. For those willing to ride through market fluctuations and invest for the long term, SBI Small Cap Fund has the potential to deliver significant returns.

Best Hybrid Mutual Funds for SIP in 2024

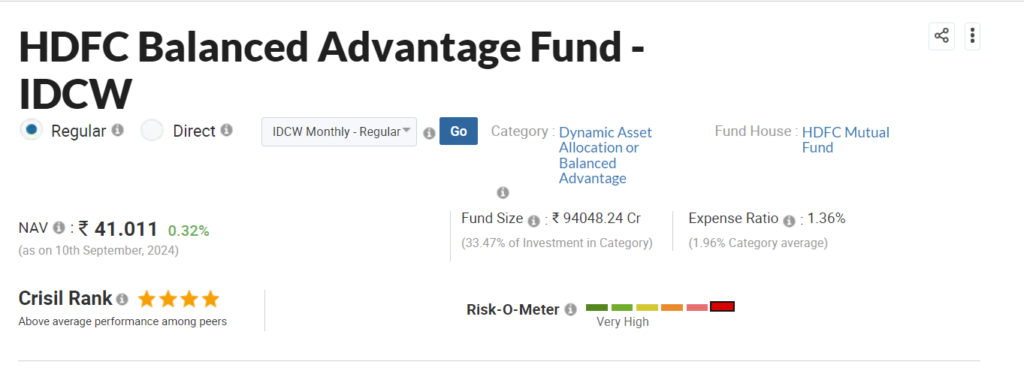

HDFC Balanced Advantage Fund

Hybrid funds, which invest in a mix of equities and debt, offer a balanced approach to risk and return. The HDFC Balanced Advantage Fund is a top pick in this category, offering the potential for capital appreciation with a lower risk profile compared to pure equity funds. This fund dynamically adjusts its asset allocation between equity and debt based on market conditions, making it an ideal choice for investors seeking a balance between growth and stability.

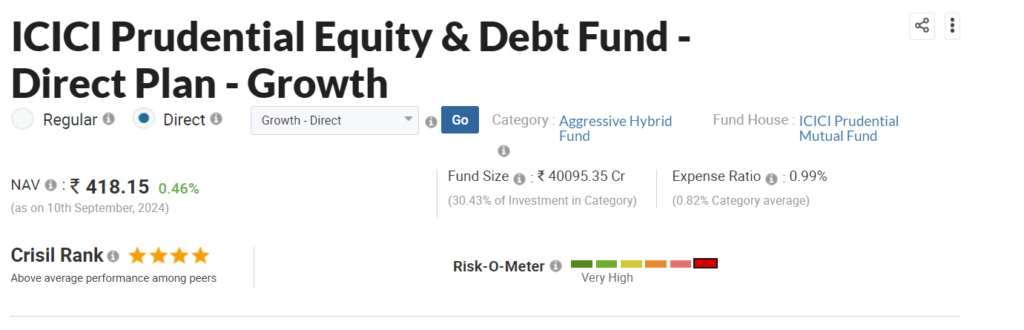

ICICI Prudential Equity & Debt Fund.

ICICI Prudential Equity & Debt Fund is another strong contender in the hybrid category, providing a good mix of growth and income. The fund has a track record of delivering consistent returns by investing in a diversified portfolio of equities and fixed-income instruments. This fund suits investors looking for moderate risk and stable returns through SIPs in 2024.

Best Debt Mutual Funds for SIP in 2024

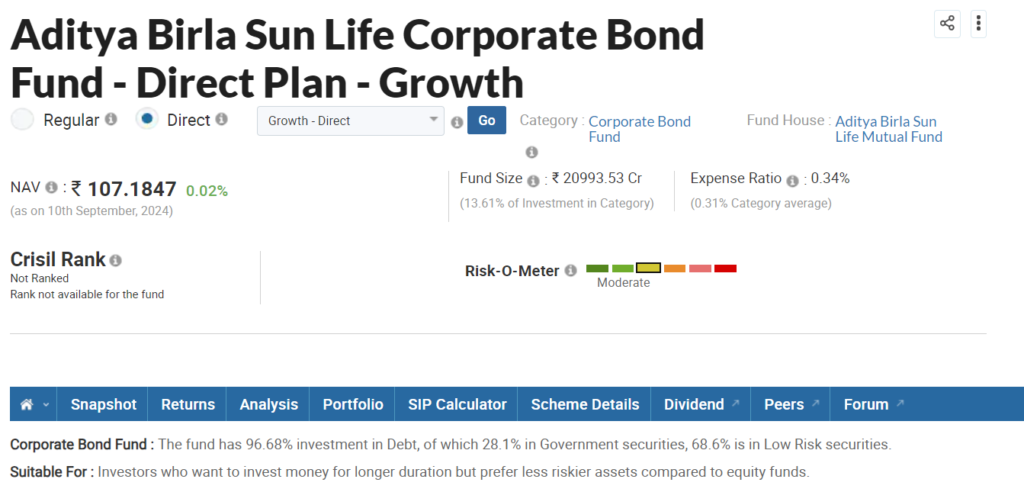

Aditya Birla Sun Life Corporate Bond Fund

For risk-averse investors, debt mutual funds offer a safer avenue for SIPs. The Aditya Birla Sun Life Corporate Bond Fund is a top choice in this category, focusing on high-quality corporate bonds with stable returns. The fund aims to provide regular income with low to moderate risk, making it an excellent option for conservative investors or those nearing retirement.

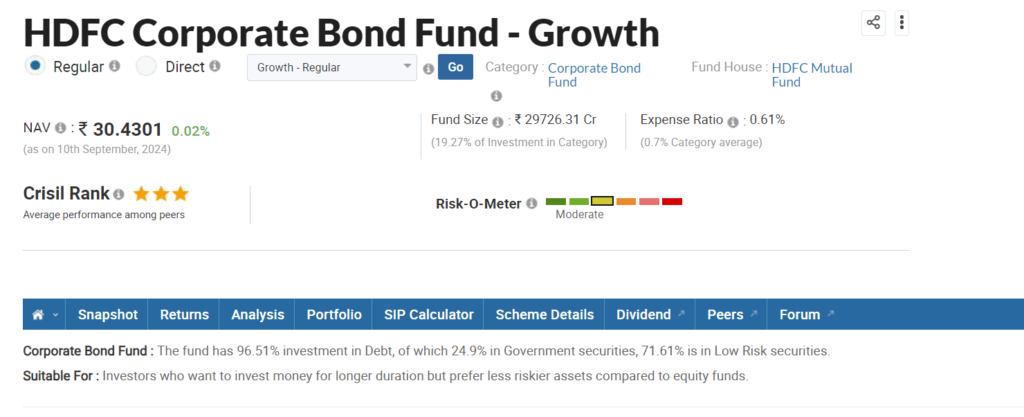

HDFC Short Term Debt Fund

HDFC Mutual Fund offers a range of debt mutual fund schemes that focus on investing in fixed-income securities like government bonds, corporate bonds, treasury bills, and other debt instruments. The primary goal of these funds is to provide steady income with relatively lower risk compared to equity mutual funds.

Key Features of HDFC Mutual Fund Debt Schemes:

- Lower Risk: Debt funds generally carry lower risk as they invest in fixed-income securities. The risk is mainly associated with interest rate changes and credit quality of the securities in the portfolio.

- Steady Income: These funds are designed to generate regular income for investors by investing in bonds that pay fixed interest.

- Variety of Debt Funds: HDFC Mutual Fund offers various types of debt funds such as:

- Liquid Funds: For short-term parking of surplus funds with high liquidity.

- Short-Term Debt Funds: Suitable for a time horizon of 1-3 years.

- Corporate Bond Funds: Focus on high-quality corporate bonds with better returns than government securities.

- Credit Risk Funds: These funds take on slightly higher risk by investing in lower-rated corporate bonds for higher returns.

- Tax Efficiency: Debt funds held for more than three years benefit from long-term capital gains tax with indexation benefits, making them tax-efficient compared to traditional fixed deposits.

- Interest Rate Sensitivity: Debt funds are affected by changes in interest rates. When rates rise, bond prices tend to fall, which could affect the fund’s returns. However, fund managers actively manage portfolios to optimize performance.

- Suitability: These funds are ideal for conservative investors looking for stable returns with less exposure to market volatility. They are also useful for diversifying portfolios to balance risk.

Before investing in any HDFC debt mutual fund, it’s important to assess the fund’s portfolio, credit quality of the securities, and the interest rate environment to align with your investment objectives.

Factors to Consider When Choosing Mutual Funds for SIP in 2024

Investment Horizon

Your investment horizon is crucial in selecting the right mutual funds for SIP. Equity funds, especially small-cap and mid-cap funds, are better suited for long-term investments (5-10 years or more), while debt funds are ideal for shorter investment periods.

Risk Appetite

Different mutual funds come with varying levels of risk. Equity funds generally carry higher risk but also offer the potential for higher returns. Hybrid funds provide a balanced approach, while debt funds are lower risk, suitable for conservative investors. Assess your risk tolerance before deciding on a fund.

Fund Performance

While past performance is not indicative of future results, it provides insight into how a fund has managed different market cycles. Look for funds with consistent performance over 3, 5, and 10-year periods.

Expense Ratio

The expense ratio, which is the fee charged by the mutual fund for managing your investments, directly impacts your returns. Opt for funds with a lower expense ratio to maximize your gains.

Fund Manager’s Track Record

The expertise and experience of the fund manager play a significant role in a fund’s performance. Research the track record of the fund manager, including their tenure and performance across different market cycles.

How to Start a SIP in 2024

Starting a SIP is straightforward and can be done through various platforms such as mutual fund houses, brokers, or online investment platforms. Here are the steps:

- Choose the Right Fund: Based on your investment goals, risk appetite, and the factors mentioned above, select the mutual fund that best suits your needs.

- Set Up an Account: If you don’t already have one, set up an investment account with the mutual fund house or a broker.

- Select the SIP Amount and Tenure: Decide the amount you wish to invest regularly and the duration of the SIP.

- Complete the KYC Process: Ensure you have completed the Know Your Customer (KYC) process, which is mandatory for mutual fund investments in India.

- Automate Your Investments: Set up an auto-debit from your bank account to ensure timely and consistent investments.

- Monitor Your Investments: Regularly review your portfolio and make adjustments if necessary to stay aligned with your financial goals.

Best Mutual Funds for SIP in 2024

When it comes to the best mutual funds for SIP in 2024, the key is to align your investments with your financial goals, risk tolerance, and time horizon. Whether you prefer equity funds for long-term growth, hybrid funds for balanced risk and return, or debt funds for capital preservation, there are excellent options available in the market. Remember, consistency and discipline are the cornerstones of successful SIP investing. By carefully selecting the right funds and staying committed to your investment plan, you can build a robust portfolio that stands the test of time.

FAQs

What is the minimum amount required to start a SIP?

The minimum amount to start a SIP can be as low as INR 500 per month, depending on the mutual fund.

How do I choose the best mutual fund for SIP?

Consider factors like your financial goals, investment horizon, risk appetite, fund performance, and expense ratio.

Can I stop a SIP anytime?

Yes, you can stop a SIP anytime. However, staying invested for the long term is recommended to reap the full benefits of compounding.

Is SIP a good option for long-term investment?

Yes, SIPs are ideal for long-term investment as they allow you to benefit from rupee cost averaging and compounding over time.

What happens if I miss a SIP payment?

Missing a SIP payment does not attract any penalty. However, it’s advisable to maintain regular contributions for consistent growth.

Are returns from SIP taxable?

Yes, returns from SIPs are taxable based on the type of mutual fund and the holding period. Equity funds are taxed at 15% for short-term gains and 10% for long-term gains beyond INR 1 lakh. Debt funds are taxed as per the investor’s income slab for short-term gains and 20% with indexation for long-term gains.